Gargaara Finance Limited

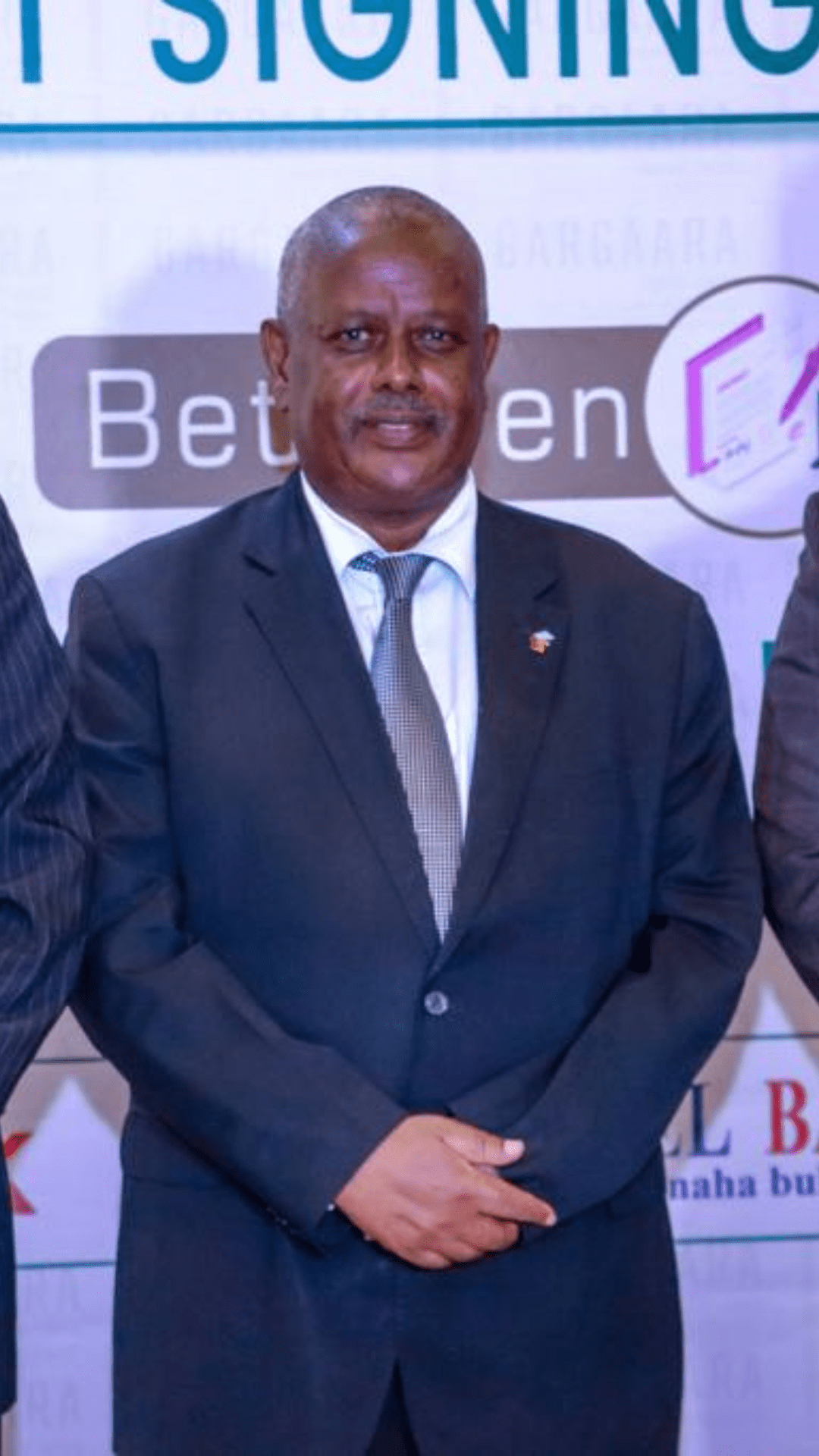

Message From The CEO

Welcome to Gargaara, an Apex financial institution which is created to achieve the twin goals of a) enhancing the capacity of Somalia’s financial sector and, b) funding Micro Small, and Medium Enterprises (MSMEs) which are legally operating in Somalia. Gargaara is registered with the Central Bank of Somalia to operate as a microfinance institution within the territory of Somalia.

As a wholesale financier, Gargaara aims to provide concessionary financing to commercial banks and micro-financial institutions on an on-lending basis. Our target sectors are productive sectors (farming, livestock, fishery) and renewable energy. Gargaara is wholly funded by the World Bank and other associated Development Financial Institutions (DFIs), and we have plans to allow private investors to invest with us. Gargaara is wholly owned by the Federal Government of Somalia through the Ministry of Finance. Yet, it is independently managed on a commercial basis.

Apart from the provision of financing, Gargaara aims to strengthen the banking sector by providing them with technical assistance to upgrade their skills in lending, risk management, and governance. Likewise, it also aims to offer Business Development services to MSMEs in business management, market studies, preparation of business plans, delivery of bankable proposals to financial institutions, etc. Gargaara funding is specifically designed to encourage financial inclusion for women, youth, and marginalized sections and regions of the country.

With the combined impact of our interventions in offering finance, technical support, and business development services to worthy sectors, Gargaara is set to transform the Somali economy. As we go on this exciting journey, we hope to expand our services to sectors like agricultural processing, healthcare, education, manufacturing, hospitality, and traveling. We are truly excited about the prospect of bringing transformative change to the livelihood and the welfare of our people in Somalia, and we hope you will join us in this rewarding journey.

Sulieman A Dualeh — Chief Executive officer

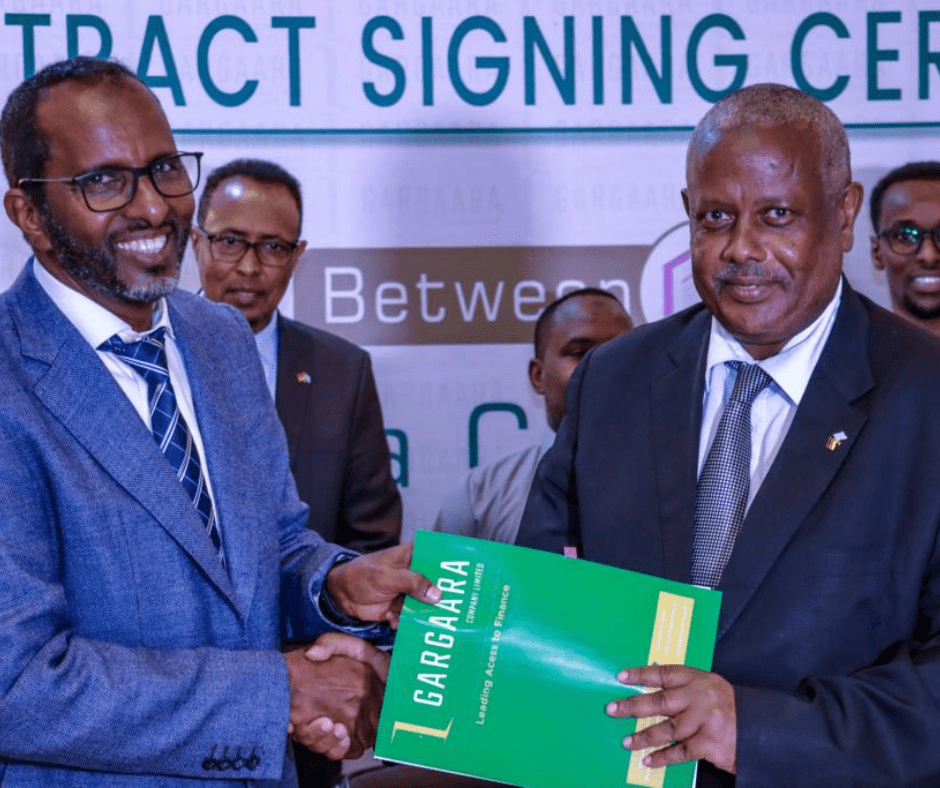

Gargaara Financial Limited

GARGAARA is an apex Financial Institution, licensed by the Ministry of Commerce and registered by the Central Bank of Somalia, established as a dedicated and autonomous agency. We are a leading financial institution in Somalia, facilitating access to finance for Micro, Small and Medium enterprises (MSMEs). We take a bold and innovative approach to drive reform within the financial sector and create financial inclusivity. Our development plan, market innovation and professional financial services formalize businesses to ensure they are properly structured to facilitate financial intermediation. Through this inclusion, guidance, and support, we seek to unlock the potential of MSMEs in Somalia and deliver economic empowerment and opportunities to the underfunded MSME sector. Our direct and indirect beneficiaries include Participating Financial Intermediaries (PFIs) and MSMEs to whom we provide knowledge and experience in lending and working with local financial institutions, and access to finance for expanding their businesses in Somalia. GARGAARA was incorporated in April 2019 by the Ministry of Finance of Somalia in acknowledgment of the country’s thriving private sector, well-connected business community, and desire for international trade and investment. Since June 2020, GARGAARA has disbursed $13.6 million under the Small, Medium, and Large Windows through Amal, Premier, IBS, Amana, Daryeel, Sombank, MyBank, and KIMS MFI. GARGAARA funding by region for 2020-2021 was as follows:

Livestock

Fisheries

Energy

Agriculture

Agri & energy

Vision

To be a leading financial institution in delivering financial development and financial inclusion for Somali MSMEs.

Mission

GARGAARA envisions a thriving MSME sector that drives entrepreneurship, employment and economic growth across Somalia.

our core values

We use courage

and commitment to push boundaries and look at traditionally neglected higher risk markets with huge potential in order to unlock the economic potential of MSMEs in Somalia.

Authenticity and professional business relationship, achieved through truth and transparency in every engagement, are the core of everything we do.

We seek to free Somali entrepreneurs and businesses

from limited opportunities through a profit driven social enterprise that provides funding

and integration into the financial system, particularly for vulnerable members of the community – women and youth.

We operate with

the highest ethical practices and professionalism, leading by example in setting the standard for all businesses in the Somali financial sector.